The recent increase in market capitalization concentration has been the steepest on record in more than 60 years of history, with an even narrower lead than that seen during the TMT bubble. (JPM)

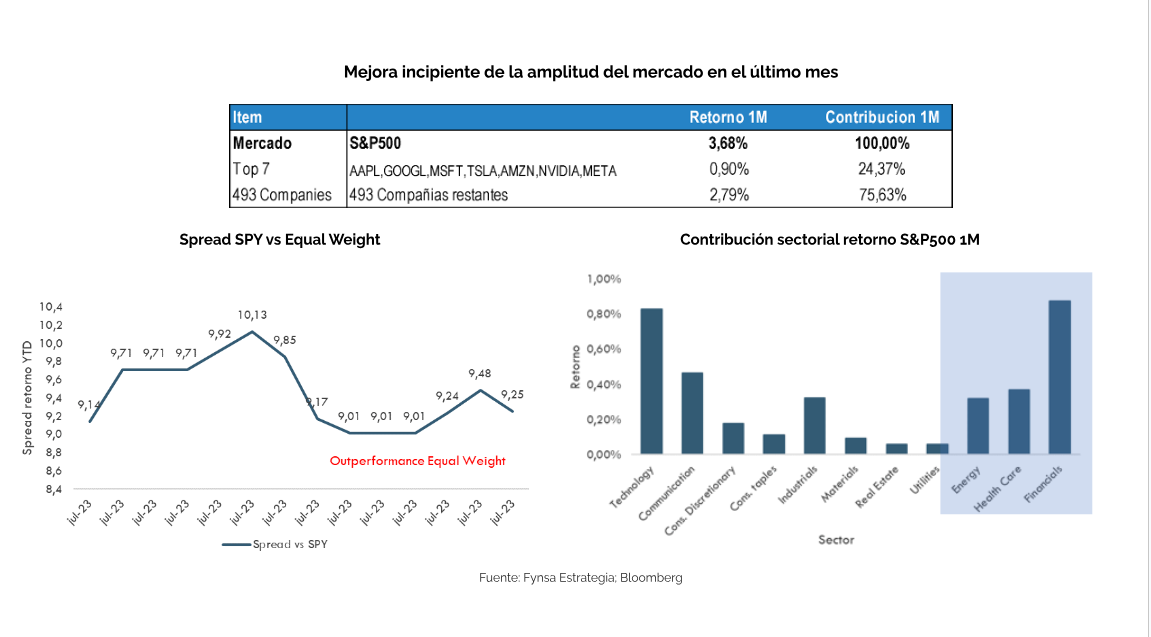

Year-to-date, six mega-cap LLM Innovation LLM companies (MSFT, GOOGL, AMZN, META, NVDA and CRM) explain 51% of the S&P 500's performance, 54% of the Nasdaq 100's performance and 63% of the growth factor.

In the past, a sharp increase in concentration and narrow leadership has always been reversed, with the S&P 500 equal-weighted index outperforming the market cap-weighted index.

Of course, this alone is not a sufficient reason to sell the US market, as reversing this extreme rally would require a catalyst in the form of an additional inflationary shock (2022-style) or a hard landing of the economy, and that is not part of our baseline scenario. Otherwise, corporate earnings have continued to surprise on the upside, and economic data continues to show a more resilient economy..

But if history is any guide, we believe that a "different way" of gaining exposure to the U.S. market is warranted.(see attached table), since a sharp increase in concentration is generally followed by an outperformance of the equal-weighted index relative to the market capitalization-weighted index, resulting in a reversal of concentration (see attached table).

In the first 6 months of the year, the capitalization-weighted index (SPX) outperformed the equal-capitalization-weighted index (SPW) by ~10%; since then (and particularly in recent weeks), the SPW index has outperformed the SPX index by ~1%. History suggests that further market share expansion should persist for several more months.

We recommend a more balanced exposure to address the heavy concentration of the US market and overweight ex-US markets, where valuations are more attractive and with higher dividend yields. In the US, consider an equal-weighted index (RSP ETF). In terms of sectors, our strongest convictions are in Technology (XLK ETF) and Health Care (XLV US ETF), although we believe small- and mid-cap companies (IWM ETF) should also be considered to complement large-cap holdings (SPY ETF) and diversify with some value cyclicals, laggards Financials (XLF ETF) and Energy (XLE ETF).