It is no news that the values at which the exchange rate is managed are going up more and more, which makes us begin to believe that its floors and values seem to be above expectations.

A country's currency can be understood as a sort of extension of its economy (although not always in correlative terms). In an economy such as Chile's, the exchange rate has been linked to what has historically been our main export: copper. However, starting from a zero base, at the beginning of 2013 and following the returns of the Chilean peso and copper, we observed a significant decoupling (and more importantly, a gap that did not close).

It is in this context that we try to think back and recall events that may have marked the evolution of our currency, important moments that contributed to enhance the love-hate relationship we have with the dollar. That said, it is worth mentioning the decoupling observed between 2019 and 2020, with the social outbreak and the pandemic (and more importantly, how this gap did not close). Would it have been a local factor or did the pandemic sweep away currency values?

Now, when we want to know the state of the U.S. dollar, a well-known tool is the DXY index: A register that weights different currencies to know the relationship between the U.S. dollar and the global economy. DXY index: A register that weights different currencies to know the relationship between the dollar and the global economy. Although, historically the peso has moved with certain correlation with respect to this index, we can observe that since October 2019 the same decoupling that we observe in the graph with copper returns appears.

This, apart from reinforcing the previous point, may explain why the gap was not closed. Looking at it even more in depth, this gap seems to have grown again in a similar way as we saw in the first graph.

Examples such as the above are just a sample used to show how some data historically used for their projective capacity in the exchange rate, seem to fail to explain values that move in a manner fouled by their own turbulence.

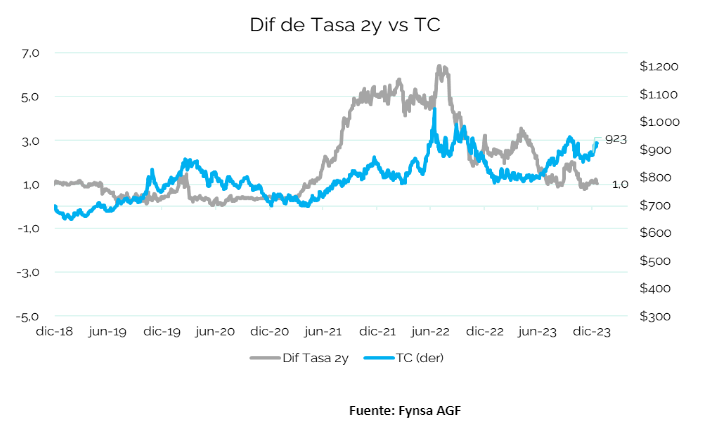

In the following graphs we can see how the movement of CDS does not seem to explain the phenomenon, showing a growing gap; and the rate differentials with the United States do not seem to explain it either.

During the period in which we experienced an increase in interest rates from mid-2021 to the end of 2022, we observed how the value of the peso moved from below $750 to above $900. There were times when it even surpassed $1,000. During this process, the monetary policy rate rose from 0.5% to 11.25%.

In a context of lower rates, projected by both the Central Bank and the Federal Reserve, it will be especially relevant to be able to have certainty as to how our currency will move and its effect on our day-to-day life. In the immediate term, in this last chart, we can see how the inflation forward has also decoupled from the exchange rate... certainties and correspondences that are so much missed lately, what the exchange rate (and maybe something else) took away.

In a context of lower rates, projected by both the Central Bank and the Federal Reserve, it will be especially relevant to be able to have certainty as to how our currency will move and its effect on our day-to-day life. In the immediate term, in this last chart, we can see how the inflation forward has also decoupled from the exchange rate... certainties and correspondences that are so much missed lately, what the exchange rate (and maybe something else) took away.

Gabriel Haensgen

Fynsa AGF Team