This week's U.S. monetary policy decision was particularly complex, given recent developments in the financial system and inflation that remains at elevated levels.

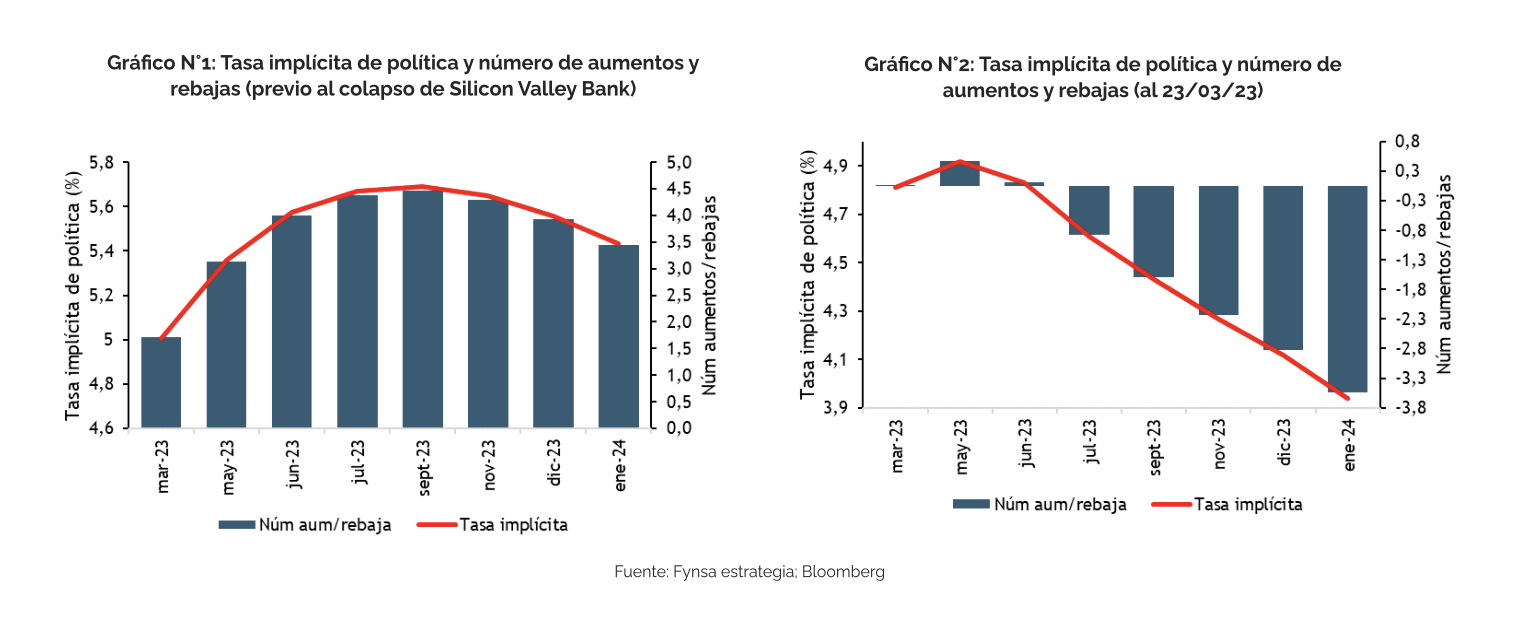

Recall that, following a series of upside surprises in economic data during February, the market began to lean toward a more aggressive monetary tightening cycle than previously incorporated.The market began to price in as much as a 100 basis point increase in the federal funds rate to levels approaching 6%.

That said, things have changed dramatically since the collapse of Silicon Valley Bank and the subsequent liquidity crisis, including a record outflow of deposits from the system, which has led the market to go from incorporating 100 basis points more rate hikes for this year, to almost 100 basis points of cuts (see chart n°1 and n°2).

Against this backdrop, the Fed opted this week for a delicate balance in continuing to emphasize its commitment to 2.0% inflation, raising the federal funds rate by 25 basis points to the 4.75% - 5.0% range..., but "moderating the language" of the statement somewhat, which shifted from "ongoing increases" in favor of the less hawkish and less committed phrase that "additional policy tightening may be appropriate."

Referring to the financial system, the statement noted that the "U.S. banking system is sound and resilient" and that recent developments are likely to result in tighter credit conditions for households and businesses and to weigh on economic activity, hiring and inflation. and that recent developments are likely to result in tighter credit conditions for households and businesses and weigh on economic activity, hiring and inflation. And at the press conference, in discussing the various bank bailout policies, Powell said that "these actions demonstrate that all depositors' savings in the banking system are safe."

This would seem to suggest that the authorities are willing to invoke the systemic risk exception whenever a bank fails. When Powell was asked to clarify his comment, he was terse, repeating that "depositors should assume that their deposits are safe". Powell also noted that "deposit flows into the banking system have stabilized over the past week." To the extent that the Fed has a more timely look at bank balance sheets than the public, this was encouraging news.

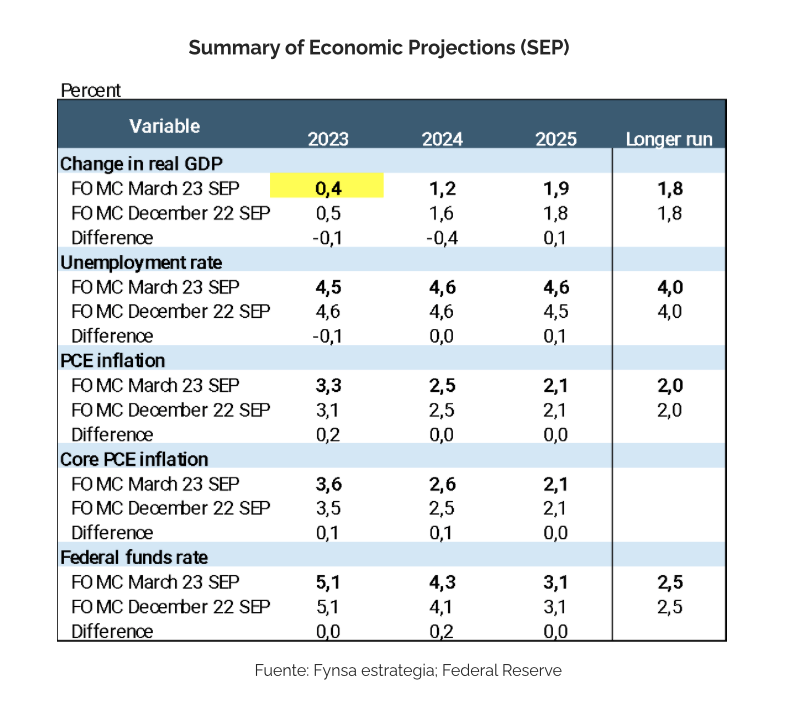

Regarding the economic projections (see table below), there is a hint of a potential additional hike and then a "pause mode", after which the next move will most likely be a cut, in our opinion. Although Powell himself rejected expectations of a rate cut, the poor growth outlook projected for this year (+0.4%), which practically "implies a potential recession", makes us think that rate cuts may be likely this year.

A growing debate regarding monetary policy concerns whether the mandates to control inflation and maintain financial stability can be addressed differently and separately. whether the mandates to control inflation and maintain financial stability can be addressed differently and separately.

In this sense, Powell adhered to the idea of separating financial stability from monetary policy tools, albeit with limitations. When asked if he was concerned that a rate hike could exacerbate the problem at banks, he said that the rate decision was "focused on macroeconomic outcomes" and that the banks' situation would be addressed by their credit lines. That said, it is difficult to separate these issues, and the statement also noted that recent banking developments "are likely to result in tighter credit conditions."

In our view, the two objectives are closely linked: higher monetary policy rates increase bank funding costs and reduce loan demand, reducing bank profits and tightening financial conditions, thereby cooling economic activity and ultimately inflation. It is very likely that the buildup of financial stress will require the Fed to be much more cautious about future monetary tightening.

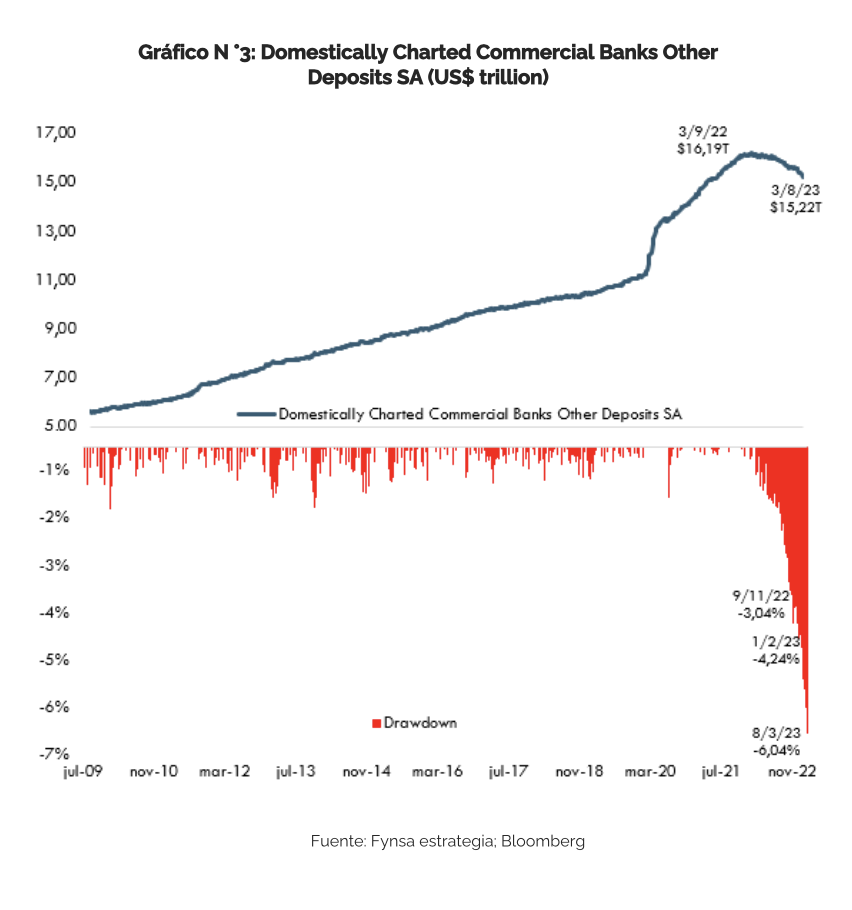

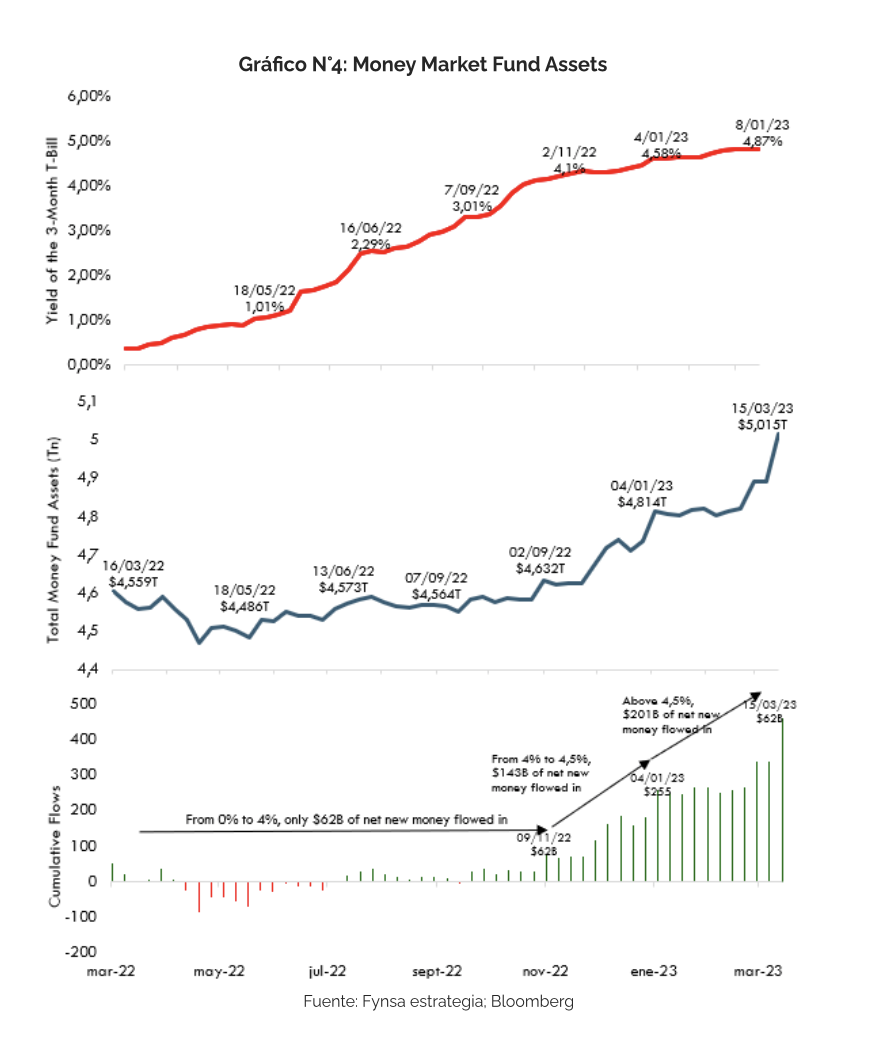

Higher rates have otherwise contributed to financial stress by eroding the deposit base of banks: U.S. depositors are exiting banks and entering money market funds to take advantage of higher rates. Recent bank failures may have accelerated those outflows, risking a credit crunch that could generate recession and deflation. If the high Fed funds rate is the ultimate cause of the current financial stress, then the easiest way out is for the Fed to stop raising rates and start cutting.

"A Central Bank's credibility is also at stake by doing what makes the most sense for the economy depending on the circumstances."

Graph N°3 is taken from the Fed H8 report. It is updated with the latest data available as of March 8, two days before Silicon Valley Bank failed. What has been the largest withdrawal of deposits since the financial crisis? The weeks before the bank failures of the last few weeks.

So why was there a large flight of deposits from banks before the failures? As Graph N°4 shows, as rates moved from 0% to 4% between March and November 2022, inflows into money market mutual funds were US$ 62 bn. This changed as rates crossed above 4%. US$ 143 bn flowed into money market funds as rates rose from 4% to 4.5%. Another $201 bn flowed into money market funds as rates rose above 4.5%. Again, the public's attitude about the movement of money changed as rates crossed above 4%.

We invite you to review more details of how the bank liquidity crisis has evolved, through an update of the report published last week: Silicon Valley Bank Collapse Causes and Consequences.