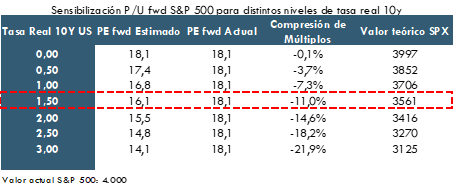

Shortly after the Fed's early February meeting, and following a series of stronger than expected economic data, interest rates have risen sharply (see chart N°1), while equity markets initially rallied, only to partially reverse the gains so far in 2023. This opened a divergence between equities and rate levels that has not yet fully closed, despite the recent market decline.(see chart N°2).

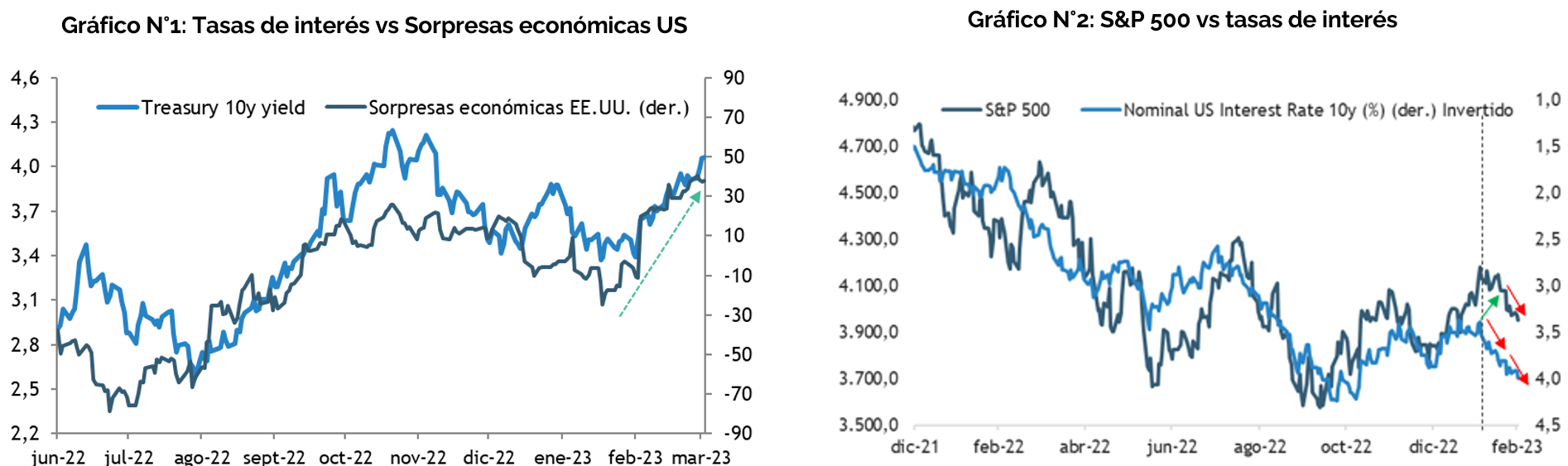

If you are a regular reader of this section of our newsletter you may recognize chart n°3, which shows how expected earnings interact with the performance of the S&P 500, but especially the interaction of interest rates with market valuations (bottom panel).

When we published our 2023 vision for international assets (See here) we highlighted that higher interest rates put pressure on valuations during 2022, but that in 2023 the focus will shift from valuations to corporate earnings, in an increasingly challenging macro environment. However, what is evident in chart n°3 is that at least so far, it is still more about interest rates. Since mid-2022, the market has gone through a series of dips and rallies that can be explained almost entirely by the trajectory of interest rates leading to multiple expansions or compressions, when expected earnings have been persistently correcting downwards.

Chart N°3: S&P 500. Price vs EPS (upper panel); P/U Multiple vs Real Rates (lower panel)

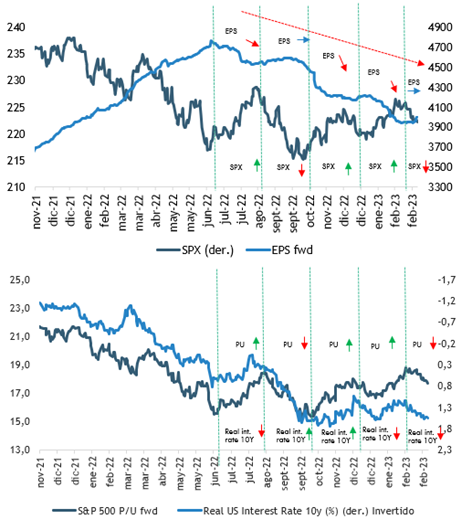

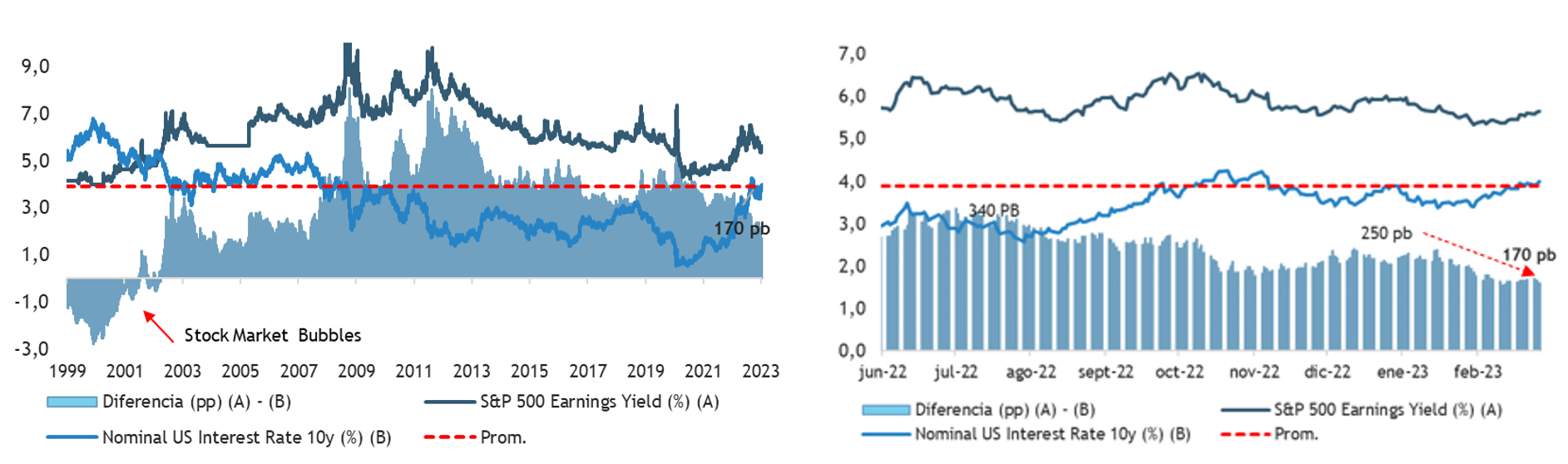

The question that follows then is why hasn't the market mostly adjusted to the renewed rate pressures? It is important to keep in mind that the early part of this year's rally can be justified by the good news of China's reopening, moderating U.S. inflation and falling natural gas prices in Europe, as well as certain rather "technical" factors, such as short covering. Thus, the narrative went from a probable recession to talk of Goldilocks and then a soft landing, which has improved corporate visibility at the margin, and which has translated into a compression of the Equity Risk Premium, which has gone from around 250 basis points at the end of 2022 to only 170 basis points at the end of February, the lowest level in 15 years. (see chart N°4)

Chart N°4: S&P 500. Equity Risk Premium

However, we believe that the divergence between equities and interest rates cannot go much further, and can be reversed. The risk-reward ratio of holding bonds for up to 2 years at the current yield level (around 5%) looks better than equities (earnings yield) than at any time since the great financial crisis (i.e., the spread between sovereign short rates and equity earnings yield is at the lowest point since 2007). (See here).

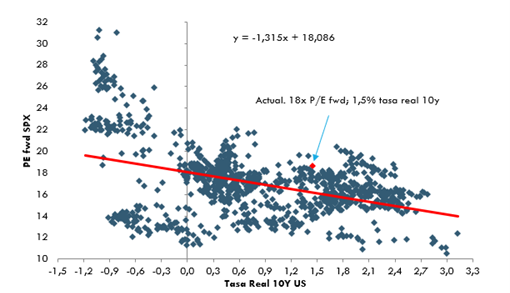

Recent economic data suggests that the tightening cycles of the major DM central banks are likely to be extended and, more importantly, less tightening/loosening is now expected after the last hike. The bond market has increasingly priced in a more hawkish scenario, but the equity market has done less so. The story implies that, for the current level of real rates, the S&P 500 multiple is ~2.0x overvalued, i.e. instead of the 18x P/U fwd it currently trades, it should be trading closer to 16x and the downside increases if rates continue to rise, which seems to be the most likely scenario (see chart N°5). Otherwise, 170 basis points of equity risk premium is not sustainable in our view, and a reversion to levels closer to 250 basis points (average of the last 12 months) seems more reasonable..

Chart N°5: S&P 500. Appreciation vs. interest rates (20y)