Consumer price index (CPI) data for September in the United States exceeded expectations. The overall index rose by 0.4% and 8.2% y-o-y (down one point from 8.3% in August). Meanwhile, the core CPI rose 0.6% on the month and 6.6% y-o-y (up from 6.3% in August), marking a new multi-decade high. Persistent strength in inflation data (combined with continued tightness in the labor market) keeps pressure on the Fed to continue tightening monetary policy.

Among the underlying components, September's strength was concentrated on the services side, with core services prices rising +0.8%, the largest monthly gain for this aggregate since 1982, with shelter (+0.7%) health care services (+1.0%) and transportation services (+1.9%) standing out.

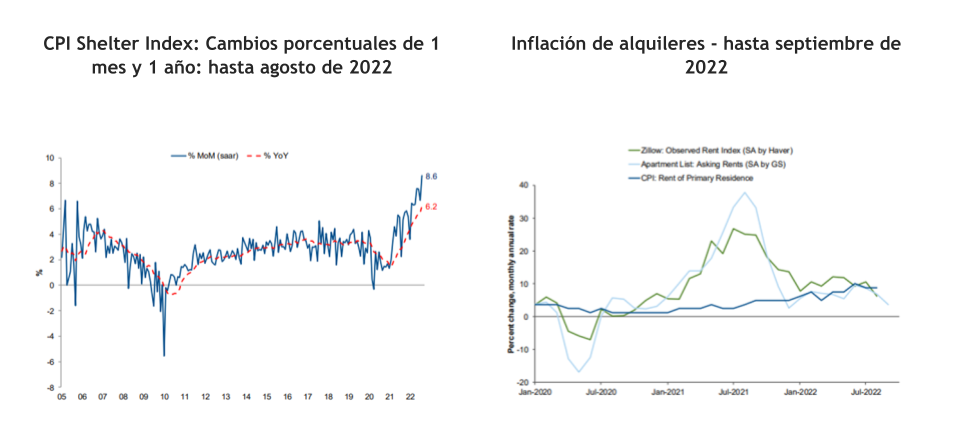

In particular, the housing categories continue to strengthen (rent +0.84% vs. +0.74% in August, OER (owners' equivalent rent) +0.81% vs. +0.71%). Now, the separate data reported by Zillow suggests that rental inflation will moderate at some point (at least relative to the particularly strong recent pace), but we may not see notably softer CPI data for at least a couple of months given the lag between these measures.

Housing inflation has risen sharply, but the pace of rent increases has moderated from the mid-2021 peak

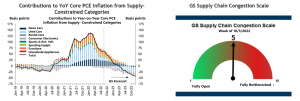

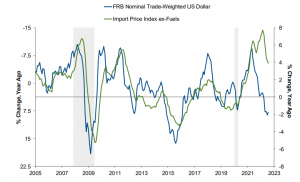

Meanwhile, commodity prices remained low in September, and this is where we are likely to see the most inflation relief coming from the easing of supply chain constraints, lower energy prices, and a strengthening dollar. Core CPI was essentially unchanged between August and September, and although the prior-year change in core CPI remained strong in September (6.6% y/y), this represented a sharp cooling from the recent peak of 12.3% y/y in February. Moderation in auto price inflation has helped the broader core goods aggregate soften of late.

Meanwhile, commodity prices remained low in September, and this is where we are likely to see the most inflation relief coming from the easing of supply chain constraints, lower energy prices, and a strengthening dollar. Core CPI was essentially unchanged between August and September, and although the prior-year change in core CPI remained strong in September (6.6% y/y), this represented a sharp cooling from the recent peak of 12.3% y/y in February. Moderation in auto price inflation has helped the broader core goods aggregate soften of late.

Outside core components, energy prices fell by 2.1% in September, while food prices rose by +0.8%.

Inflation will moderate in supply-constrained goods and the significant appreciation of the U.S. dollar will also put downward pressure on U.S. inflation

And while actual inflation, especially core inflation, is not letting up, consumer inflation expectations have declined, as have inflation breakevens.

Finally, how will this affect interest rate expectations and the Fed's response?

Last week we noted that the problem facing monetary policy is that actual inflation, and especially core inflation, is proving to be quite a bit more persistent than expected, and this has forced the Fed to remain firm on the need to keep tightening to reduce inflation. SEE .

Of course, the September inflation data only reinforces the need for further interest rate hikes and provides little sign of relief for the market, but given that there is a reasonable expectation of some moderation in inflationary pressures in the coming months, we continue to believe that we may be closer to a "peak" in terms of policy (prices today already incorporate a federal funds rate near 5% in 1Q23).