Narratives in the markets are changing rapidly. Just a couple of months ago, headlines pointed to an increasing likelihood of a recession not only in the US, but also globally. In this context, after aggressive monetary policy tightening, central banks would soon pause... We were close to a "pivot" in policy.

The underlying logic of expecting a "Fed pivot" was that the focus of monetary policy would shift from inflation to growth, a dilemma that the Fed Chairman himself was supposed to have settled in his Jackson Hole speech, where he promised to do what was necessary to rid the economy of too high inflation, even if it came at the cost of lower growth.a dilemma that the Fed Chairman himself was supposed to have settled in his Jackson Hole speech, where he promised to do what was necessary to rid the economy of too high inflation, even if it came at the cost of lower economic growth. SEE MORE.

But if anyone had any remaining doubts that the U.S. Federal Reserve is focused primarily on meeting its inflation target, they were dispelled this week. Following the conclusion of the September FOMC meeting, it is now abundantly clear that, if the cost of bringing inflation back to target is an economic pain, it is a cost the Fed is willing to accept.

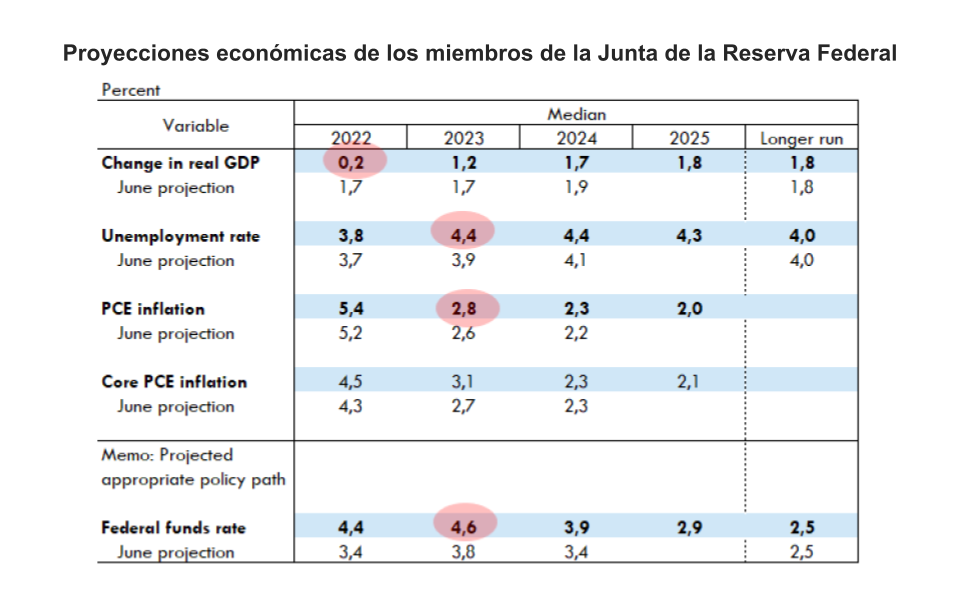

Moreover, it is a cost that policymakers increasingly expect. The median FOMC member now estimates that U.S. GDP growth for 2022 will be just 0.2%. In June, the median forecast was 1.7%. However, the deteriorating growth outlook and the prospect of rising unemployment did not deter the Fed from delivering another 75 bp rate hike and continuing with plans to shrink its balance sheet.

But even more important than the 75 basis point hike was the change in the committee's views on the future path of interest rates. Nearly two-thirds of the members now see rates peaking next year, even higher than the 4.5% that markets had contemplatedand monetary policy is projected to be "tight" over the entire projection horizon.

The FOMC's revised projections provided two key takeaways from the September meeting. The dot plot showed a median projection of another 125 bps of tightening this year and 25 bps next year, implying a 75 bps increase is the benchmark for November and the economic projections showed a higher peak unemployment rate, indicating a greater willingness to continue raising rates amid a weakening labor market if inflation remains high.

Ultimately, the trajectory of the funds rate in 2023 will certainly depend on how quickly growth, hiring and inflation slow. While there are risks in both directions, it seems more likely for now that a higher cap rate will be needed to reverse overheating, versus the Fed stopping sooner.

Scopes for asset pricing and strategies

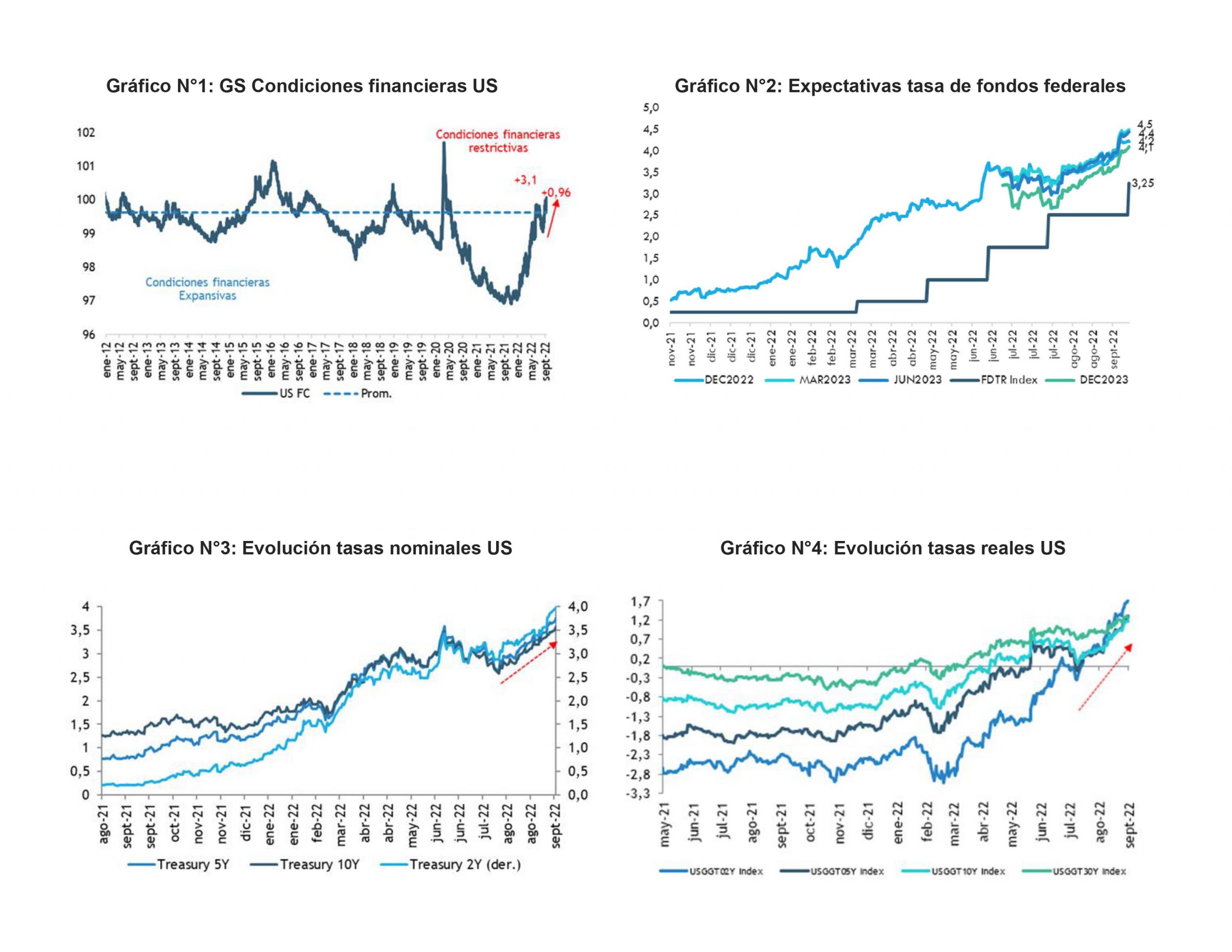

Financial conditions, after a transitory easing (which is what the Fed has been trying to correct), have tightened substantially again since Jackson Hole and are likely to continue to do so going forward. have tightened substantially again since Jackson Hole and are likely to continue to do so going forward..

Fed funds rate expectations have been adjusting to Fed projections and market rates have risen across the board in the last 30 days (UST 10y +50 bps, UST 2Y +74 bps). We still see a downside ahead of at least 50 bp, with UST 2Y would be on track for 4.5% and USD 10Y for 4.0%, keeping the curve inversion around 50 bp. And real rates are entrenched in positive territory.

Financial conditions will continue to tighten

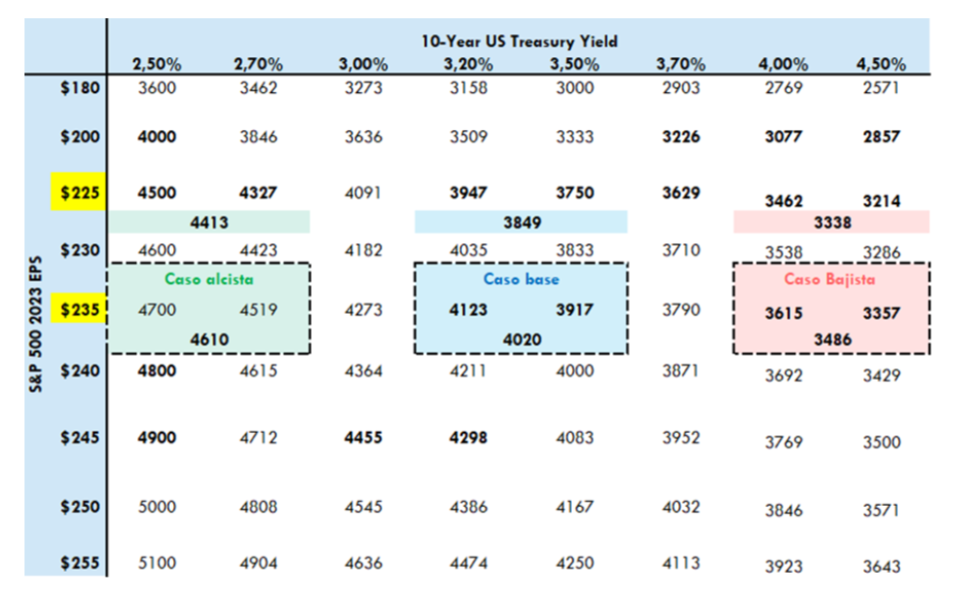

These higher interest rates would continue to put pressure on equity valuations, at a time when there continues to be some divergence in interest rate levels and equity performance.

Against this backdrop, the risks of further stock sell-offs have increased. For valuations to look really attractive, the S&P 500 would have to adjust by an additional 10% to trade at 14x P/U fwd (bearish scenario).

S&P 500 year-end 2022 forecast based on 2023 estimated earnings per share, 10-year Treasury yield; yield gap of 2.5%.

In a more complex environment for risky assets, the market today offers a number of good-performing, low-volatility alternatives to diversify the risk of a portfolio. Cash and short-term fixed income increasingly offer lower volatility and high yield to diversify risk. Six-month U.S. Treasuries yield ~3.8% and U.S. 1-5 year credit yields are ~4.9% (2.5 year duration) versus an S&P 500 earnings yield of ~6.0% (earnings yield). But over the past 30 days, the S&P 500 has been nearly 6 times more volatile.

In a more complex environment for risky assets, the market today offers a number of good-performing, low-volatility alternatives to diversify the risk of a portfolio. Cash and short-term fixed income increasingly offer lower volatility and high yield to diversify risk. Six-month U.S. Treasuries yield ~3.8% and U.S. 1-5 year credit yields are ~4.9% (2.5 year duration) versus an S&P 500 earnings yield of ~6.0% (earnings yield). But over the past 30 days, the S&P 500 has been nearly 6 times more volatile.

Finally, we believe that these dynamics will continue to support the USD (where sovereign rates are higher).