With inflation elevated, the Federal Reserve's rate tightening cycle accelerating and the U.S. yield curve inverting, investors are increasingly concerned about the risk of a recession, investors are increasingly concerned about the risk of a recession.

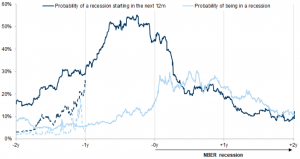

Forecasting recessions is difficult: while the yield curve has historically inverted prior to recessions, it has been less helpful in timing the recession. The current high inflation could drive earlier and deeper inversion. Since the late 1980s, the lag between yield curve inversion and US recessions has averaged 20 months, so this may be an early warning sign. That said, there are often incorrect signals. In periods of high inflation, the yield curve has inverted between 100 bps and 200 bps before a recession and mild inversion can generate an incorrect signal.

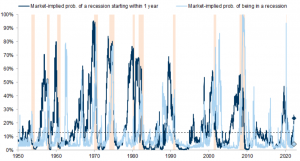

Looking at a broader range of market indicators, including cyclical versus defensive valuations, credit spreads and fed funds prices, could help gauge future recession risk.

Some indicators based on market-based indicators are leading, the most famous being the yield curve, while others, such as risk assets, react mainly during or at the onset of recessions (see footnotes).

As Goldman Sachs notes, the combination of indicators could provide a better signal: So today en average, both leading and coincident indicators have risen to date, but they are not currently pricing in much recession risk..

Source: Goldman Sachs

Source: Goldman Sachs

Source: Goldman Sachs

Source: Goldman Sachs

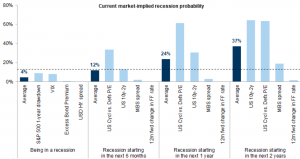

Current market implied recession probabilities are still below levels that would normally indicate a recession. Combining different segments of the yield curve, a low probability of recession is quoted over the next 12 months, but a 38% probability over 24 months. Historically, cyclical versus defensive valuations gave some wrong signals; recently, they have also likely suffered due to rising commodity prices and supply chain disruptions, rather than just recession risk.

All in all, based on the average of leading and coincident indicators, the current implied recession risk in the market does not appear to be very high, especially after the strong recovery of risky assets recently, the coincident indicators suggest that the markets have lowered the risk of imminent recession.

Source: Goldman Sachs

Source: Goldman SachsNotes: