We recently published our vision and strategy for the second quarter of 2023 (SEE HERE) where we highlighted the challenges facing both the economy and assets in the coming months, given recent stresses in the banking sector that imply tighter credit standards and increased risk of recession.

In this context, a recurring question in recent weeks is why risk assets have been doing well at the start of the year (S&P 500 has returned ~ at 8%), despite an increase in recession risks. I could give several reasons, but to be practical, I would summarize it as "lower interest rate pressures", which has led to some rotation from value/cyclical sectors to more interest rate sensitive sectors, with stronger balance sheets, more resilient earnings and more "insulated" from the stresses in the financial sector.

Specifically, Growth/Technology have regained market leadership due to falling interest rates, positive corporate results (MSFT, GOOGL and META surprised to the upside in their earnings releases this week), and the popularity of ChatGPT, which has been a catalyst for selected AI stocks (MSFT, GOOGL, AMZN, META, NVDA, CRM*) explaining 53% of the market's gains. and the popularity of ChatGPT, which has been a catalyst for select AI stocks (MSFT, GOOGL, AMZN, META, NVDA, CRM*) that account for 53% of the S&P 500, 54% of the Nasdaq 100 and 68% of the growth style year-to-date performance.

Of course, we can agree that the growth potential for AI is huge, and the big techs in the U.S. have a good track record for capturing these trends, but let's agree that current valuations (19x P/U fwd for the S&P 500 and 25x P/U fwd for the Nasdaq case), are very difficult to justify at the current stage of the economic cycle we are in, and there are lessons learned from 2022 as to the downside that paying such high premiums for certain stocks/sectors, beyond their growth potential, can mean.

Otherwise, much lower rates from current levels may be more a sign of concern than anything else, with the understanding that a 10y treasury at 3.5% already incorporates a much more dovish Fed going forward. and if rates continue to fall from here on out, it will be because we are closer to a recession than for good reasons. And if rates do rise, they will become a drag on already historically high valuations.

And while the 1Q23 corporate results have surprised to the upside, they have not been enough to push the market higher (the S&P 500 is trading at almost the same levels as 2 weeks ago, when the results were released). and we believe that this has partly to do with a declining outlook for earnings growth going forward, lower demand, further margin erosion, and a series of risks associated with lower liquidity and money supply, the debt ceiling, and potential credit events derived from a banking crisis, among others.

But returning to this year's market leadership, it is also evidence of an "unhealthy" market (we previously commented that only 6 stocks explain more than half of the S&P 500's performance). Another way to look at this is to compare the performance of the index (S&P 500) weighted by market capitalization vs. the Equal Weight index or the Russell 2000. Thus, while the former has returned ~ 8%, the latter has returned only 2.7%, and Small Cap stocks, which are more sensitive to the economic cycle (Russell 200), have returned only 1% (see graphs #1 and #2).

In that regard, we would like to share the conclusions of a report recently published by the investment bank JP Morgan, which states that the leadership of Growth/Technology sectors is often indicative of a slowdown/recession cycle and that, in the current episode, market concentration in a few growth stocks has already reached extreme levels.

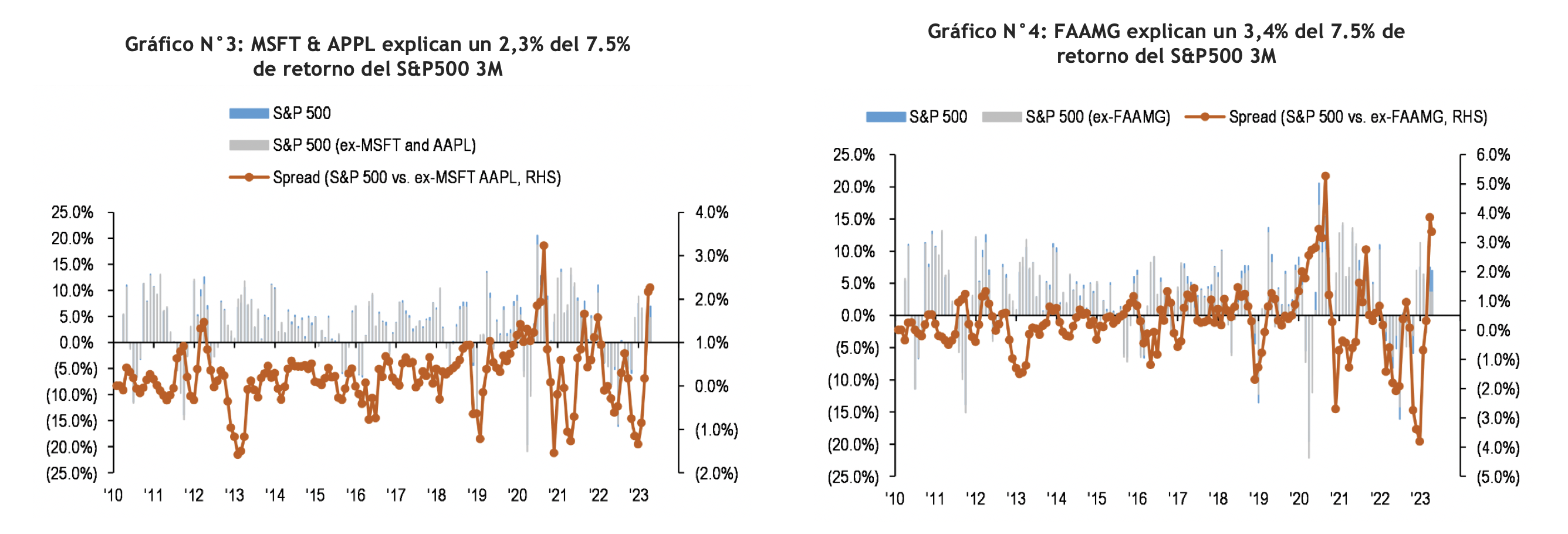

Market driven by only a handful of stocks as leadership deteriorates. Apple and Microsoft are the largest stocks in the S&P 500 and account for ~14% of the index weighting (weighting of the top 2 stocks as a % of the S&P 500 index at new highs). Over the past 3 months, the S&P 500 index is up ~7.5%, of which 2.3% was driven by these two names alone (~1/3 of the returns). Looking next at FAAMGs, we note that they represent ~21% of the index weighting and contributed ~3.4% to the ~7.5% total return over that same period (~1/2 of the returns). Moreover, the entire ~7.5% of the S&P 500 return can be fully explained by just 28 stocks (see charts #3 through #6).

10 vs. the next 40 stocks in the S&P 500. In a historical comparison, the current S&P 500 index weighting in the 10 largest stocks is ~29% and is in the 96% percentile since 1980 (higher than TMT and GFC, only lower than COVID peak levels, while the index weighting in the 11-50 largest stocks within the S&P 500 is in the 24th percentile). (see chart n°7 and n°8)

Finally, as the table below shows, there is a significant disconnect between the valuation and growth of the major stocks contributing to market profitability. In the current episode of high and increasing concentration, investors are paying the highest valuation (with the exception of 2021) despite the lowest earnings growth outlook. This is similar to other defensive rotations seen prior to a downturn in the economic cycle.

As a recommendation in terms of allocationAt the aggregate level, reduce your equity exposure in favor of fixed income. Within equities, at the regional level, overweight ex-US market where valuations are more attractive. Within the US and in terms of style and sectors, consider more defensive alternatives (Quality, Healthcare, Utilities, Staples).