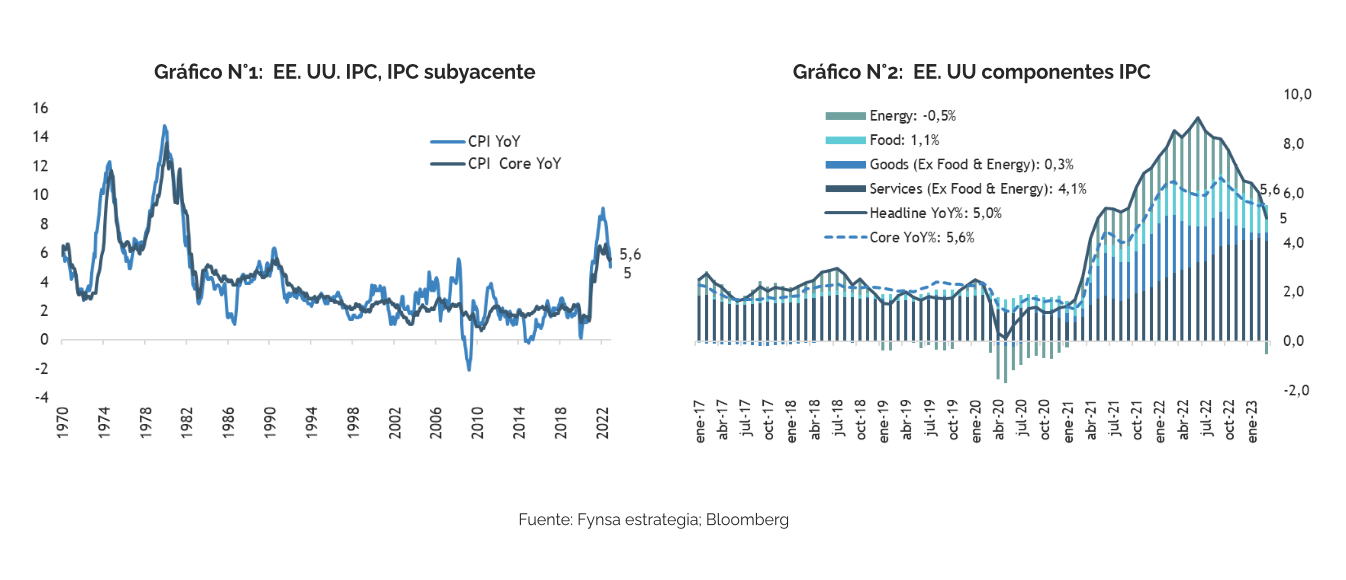

US headline inflation in March came in below expectations, although core inflation was more in line with market expectations. March CPI rose just 0.1% (or 0.053%), 0.1% below expectations, bringing the year-over-year figure from 6.0% to 5.0%. CPI excluding food and energy rose 0.4% (or 0.385%), bringing the year-on-year figure from 5.5% to 5.6%. The softer overall figure was driven by a flat food prices result, the lowest reading since mid-2020, while energy prices fell by 3.5 %. (see graph n°1 and n°2)

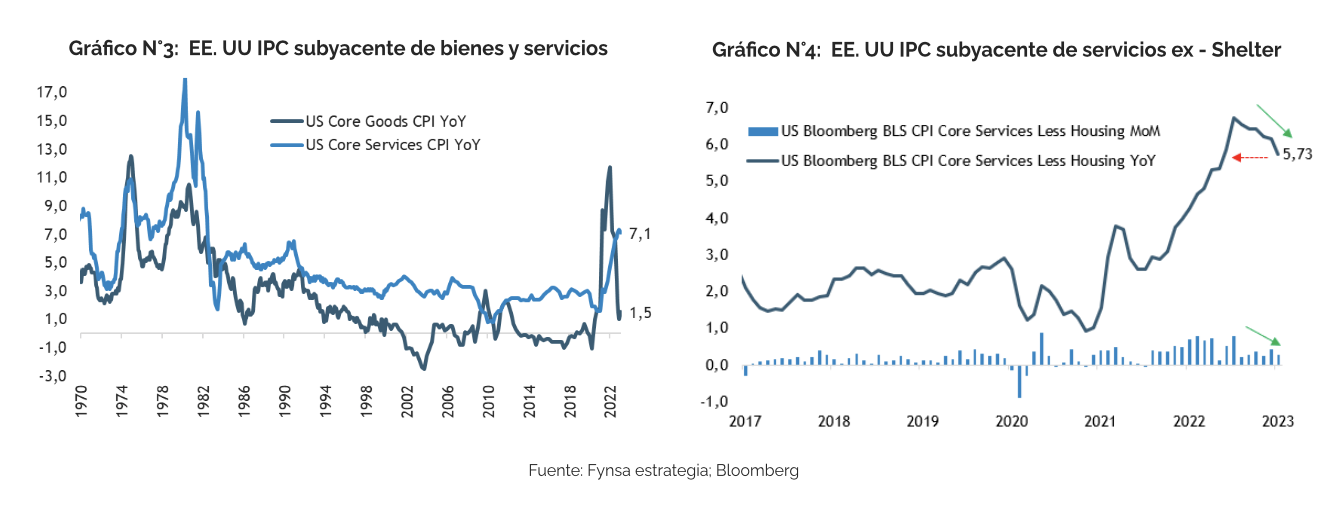

On the goods inflation side, it rose in March after 7 months of decline, (+0.2% MoM; +1.5% YoY), while services inflation decelerated modestly from +7.3% YoY to +7.1% YoY, but this slowdown is a great sign as it comes after 9 months of strong growth. (see graph n°3).

On the goods inflation side, it rose in March after 7 months of decline, (+0.2% MoM; +1.5% YoY), while services inflation decelerated modestly from +7.3% YoY to +7.1% YoY, but this slowdown is a great sign as it comes after 9 months of strong growth. (see graph n°3).

On perhaps the more hopeful side, housing (shelter) inflation may have begun to peak:

The most closely watched indicator of inflation by the Fed at the moment, the so-called 'Super-Core': Core Services Ex-Shelter, slowed to 5.73% y-o-y, the lowest since July 2022 (see chart n°4), which provides some evidence that the trend in core inflation is leaning in a more comfortable direction, so it would be reasonable to conclude that the Fed could adopt a wait-and-see approach at its next meeting, which would effectively end the tightening cycle.

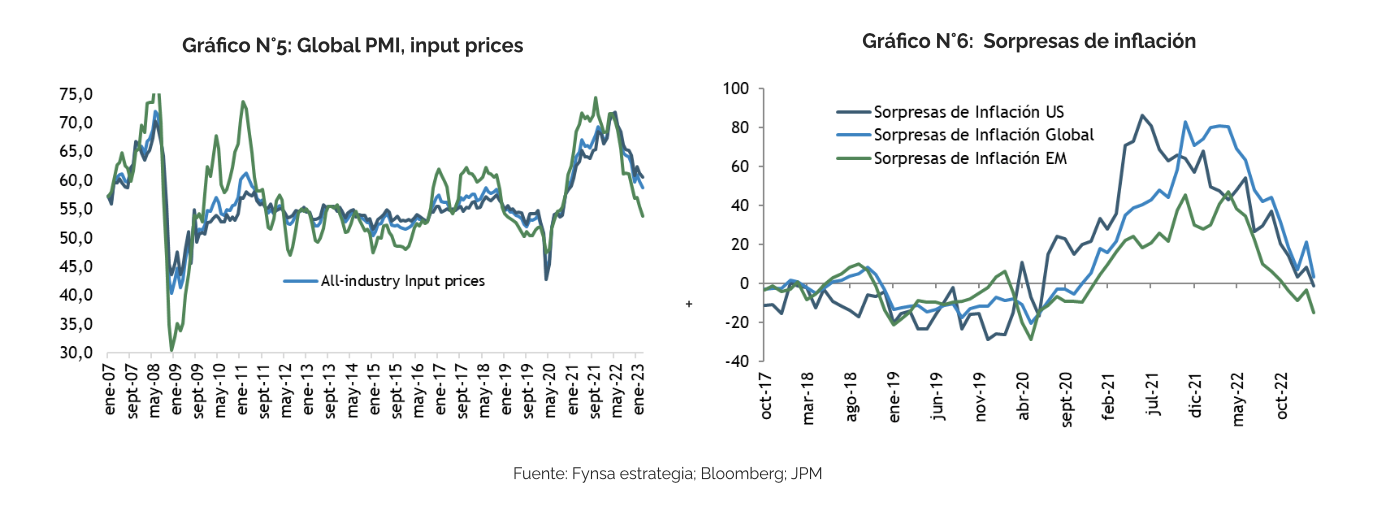

As a complement, a central element emerging from the latest Purchasing Managers Index (PMI) surveys is that corporate pricing power is fading this year relative to the multi-decade underlying inflation rates observed over the past year. The PMIs show that the extreme price pressures of the past year are fading rapidly. However, the decline in services is occurring at a much slower pace than in manufacturing. On net, the all-industry price PMI remains above the highs recorded in the previous expansion.

As a complement, a central element emerging from the latest Purchasing Managers Index (PMI) surveys is that corporate pricing power is fading this year relative to the multi-decade underlying inflation rates observed over the past year. The PMIs show that the extreme price pressures of the past year are fading rapidly. However, the decline in services is occurring at a much slower pace than in manufacturing. On net, the all-industry price PMI remains above the highs recorded in the previous expansion.

This is consistent with the view that core inflation slips this year, but does not fully return to the central bank's comfort zone, which keeps policy rates higher for longer, that is under the assumption that the Fed achieves a soft-landing. However, the combination of higher borrowing costs and the tightening of credit conditions that will inevitably result from the fallout of the recent banking stress increases the risk of a hard-landing. This would make it even more likely that inflation will return to the 2% target sooner than budgeted. Read more.

And look at what Chart No. 6 shows, which measures inflation surprises in different regions. The market underestimated global inflation for virtually all of 2021. Well, headline plus, headline minus, what we have in practice is that over the last 12 months the market has overestimated inflation, and will surely continue to do so under the logic of "more resilient demand" due to still healthy labor markets.

We will leave for another opportunity to address how strong the labor markets are, particularly in the U.S., but since today's focus is inflation, here is some wage data from a recent Bank of America study, which differs from the official figures in U.S. employment reports, and showing that wage growth, like real wages, is in free fall: "growth in after-tax wages and salaries, according to BofA warehouse data, slowed to just 2% y/y in March on a 3MMA basis, down from a peak of 8% in April 2022, the lowest since June 2020." (see graphs n°7 and n°8)

We will leave for another opportunity to address how strong the labor markets are, particularly in the U.S., but since today's focus is inflation, here is some wage data from a recent Bank of America study, which differs from the official figures in U.S. employment reports, and showing that wage growth, like real wages, is in free fall: "growth in after-tax wages and salaries, according to BofA warehouse data, slowed to just 2% y/y in March on a 3MMA basis, down from a peak of 8% in April 2022, the lowest since June 2020." (see graphs n°7 and n°8)