The U.S. December CPI report delivers a third consecutive month of good news on inflation, adding to the evidence that price pressures have peaked and putting the Federal Reserve on track to slow the pace of interest rate hikes again.

The overall consumer price index fell 0.1% from the previous month, with cheaper energy costs driving the first decline in two and a half years. On a year-over-year basis, inflation rose 6.5%, the lowest change since October 2021.

Excluding food and energy, the so-called core CPI rose 0.3% last month and 5.7% higher than a year earlier, the slowest pace since December 2021.

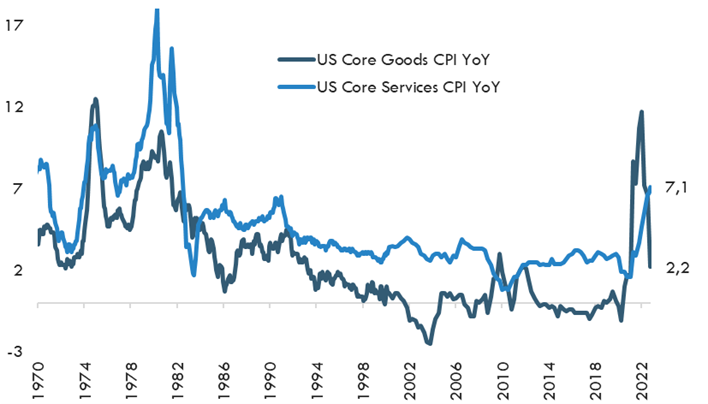

So far so "perfect". This report gives the Fed room to further slow the pace of rate hikes to 25 bp at its next meeting in Feb, although officials are likely to conclude that they still have work to do. Resilient consumer demand, particularly for services, coupled with a tight labor market, threaten to keep upward pressure on prices.

Indeed, while month-on-month CPI was negative and year-on-year CPI is declining, core CPI remains high and the strength of services inflation poses a greater challenge for the Fed. A more rigid inflation path in services will also make it more difficult for the Fed to cut rates once the economy approaches a recession, as is assumed to be the consensus view.

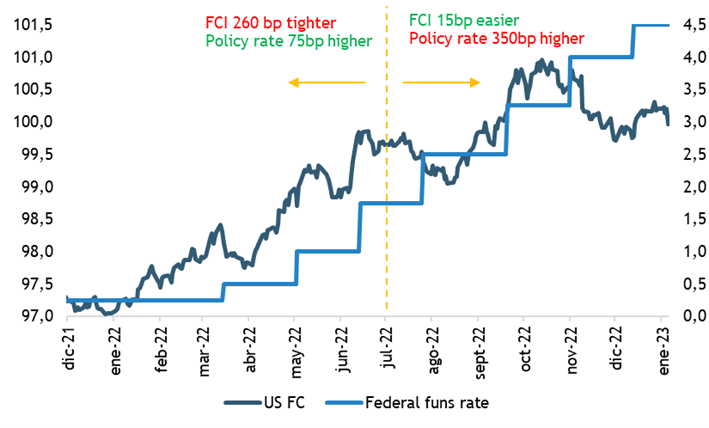

And Fed officials have already been reluctant to cut rates prematurely because of concerns about a misstep like the easing in the 1970s, just as they have been uncomfortable with recent easing in financial conditions (which conspires with the goal of keeping inflation expectations well anchored).They have also been uncomfortable with the recent easing of financial conditions (which conspires with the goal of keeping inflation expectations well anchored). US financial conditions are at the same levels as in July, despite the Fed having raised interest rates an additional 350 bps since then.

This is important, because the good performance of the markets in recent weeks is almost exclusively supported (the rest is the reopening of China), by the expectation of a substantial deceleration of inflation going forward and therefore a more accommodative interest rate stance, and also that all this is achieved within a "softlanding" economic context.

Markets have become increasingly driven by particular events. We move from CPI reports to Fed meetings and back again. The time between these events is spent speculating on what will happen at the next event. In other words, healthy markets don't work this way and, therefore, don't expect a sustained recovery, not at least not until the Fed has finished the job.

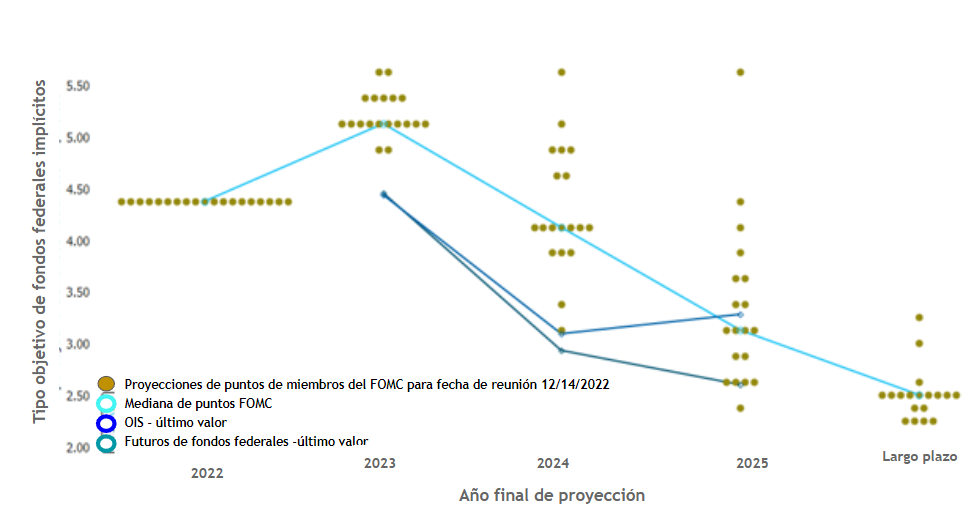

Markets are not only incorporating a further moderation in the pace of rate hikes by the Fed, but also a lower terminal rate and outright a pivot, with rate cuts starting in the second half of 2023. None of this is on the Fed's mind.