U.S. Treasury yields remain bullish amid a resilient labor market, a hawkish Fed, another inflation surprise(SEE MORE) and ongoing volatility in other DM government bond markets (especially UK). Add in a backdrop of tight liquidity and limited demand and you will find little evidence of market normalization.

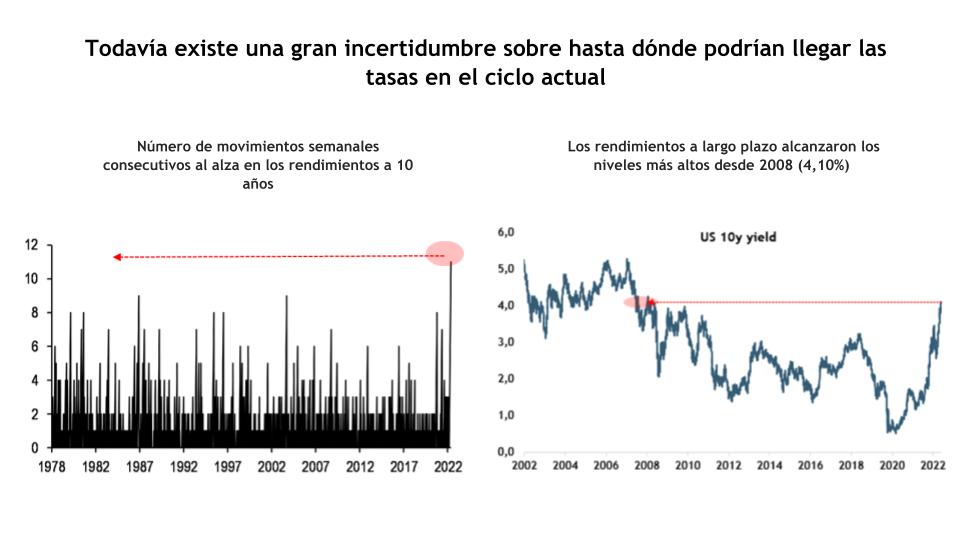

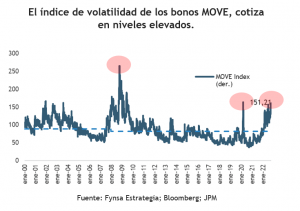

And the way things are headed for this week, rate markets will mark a new milestone, with 12 consecutive weeks of higher intermediate yields, the longest streak of increases in more than four decades; and there is still a great deal of uncertainty about how far rates could go in the current cycle, which does not encourage risk-taking, particularly as we approach the end of the year. Indeed, in light of high macroeconomic policy uncertainty, it is not surprising that risk appetite remains low and investors are unwilling to anticipate the shift to higher yields in a highly volatile environment.

Our base case continues to assume that the FOMC could slow the pace of tightening at some point in the future and we believe inflation will eventually moderate. But the available data suggest that the Fed still has more work to do to ensure that inflation returns to target.

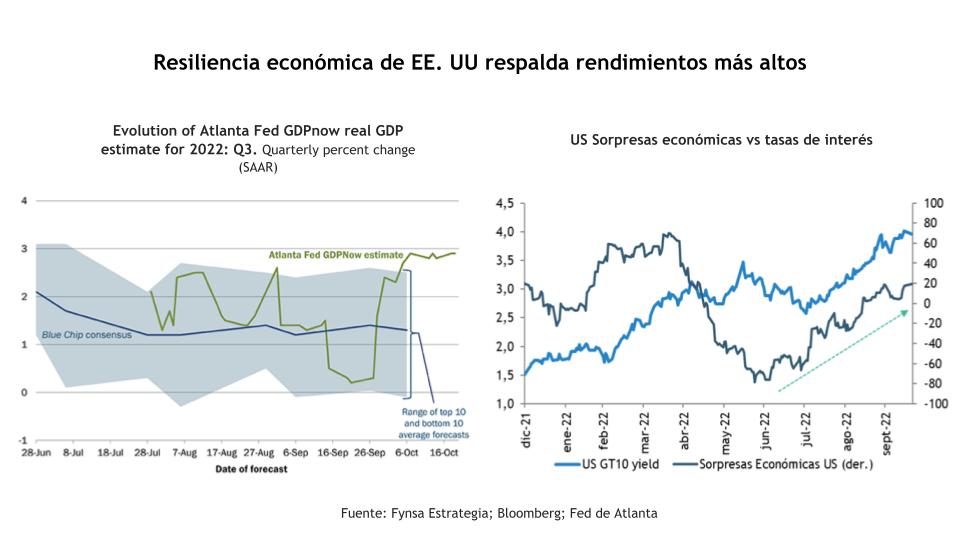

If anything has been surprising so far, it is the resilience of the U.S. economy, which appears to have strong momentum heading into the end of the year, (data recently released by the Atlanta Fed point to 3Q22 growth running at a rate closer to 3%), and economic data in the aggregate have been surprisingly rather bullish, supporting higher returns, all things being equal.

On the flow and liquidity side, lack of demand from buyers who have normally been price-insensitive by nature, including U.S. banks and foreign official investors, continued bond fund outflows, and the Fed's ongoing balance sheet reduction, add to the reasons why Treasuries may become even cheaper relative to current valuations.

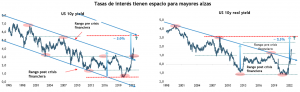

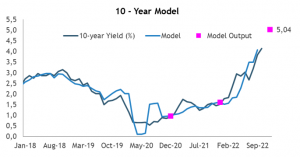

Technical signals do not seem auspicious either. During this tightening cycle, relevant technical levels have been exceeded again and again, leaving behind the trading ranges that dominated interest rates in the post-financial crisis deflationary period until the pandemic. The relevant reference levels that appear on the upside are closer to 5% for nominal 10-year rates and 2.5% for real 10-year rates.

These levels are consistent with a more fundamental model that considers inflation, growth, the federal funds rate and the Fed's balance sheet. that considers inflation, growth, the federal funds rate and the Fed's balance sheet, which points to levels of 5% for the 10-year nominal rate, with current economic realities and expectations for the federal funds rate.

So, for fixed income investors looking for a breather, there is little evidence of market normalization, especially given the duration risk that still lingers. Now, the short end of the sovereign curve is trading at its highest levels in 15 years (a 3-month treasury is approaching 4% and a 6-month at 4.5%), and we believe this part of the treasury curve offers value, particularly in a world where equities and fixed income have experienced losses of 15%-20% this year.

Finally, how do these rate risks interact with equities? As we have highlighted on several occasions, much of the equity losses so far this year are explained by the compression of multiples due to higher discount rates. In this sense, if real rates will come to trade in the 2.25% - 2.50% range, that would be consistent with a P/U fwd multiple closer to 14x for the S&P 500, which is a valuation level we have looked for as evidence to begin to put this bear market behind us.