The October consumer price index (CPI) in the US was softer than expected. The overall index rose 0.4% (vs. estimate of +0.6%), despite a 1.8% increase in energy prices and a 0.6% increase in food prices.

But even more important was the downward surprise in core inflation which rose by only 0.3% (versus an estimate of +0.5%) and with the year-on-year rate declining by three tenths to 6.3%. Services inflation in particular also slowed more than expected, with housing categories rising at their slowest pace since May and moderation in some wage-sensitive service categories, including hospital services, childcare and personal care.

Core prices were particularly weak, falling 0.4% in October, and it appears that some of the factors driving inflation over the past year have begun to ease or reverse.prices, down 0.4% in October, and it appears that some of the factors that drove inflation over the past year have begun to slow or reverse. Two areas that are particularly notable are vehicle prices and health care prices. It is likely that the increased supply of vehicles has helped alleviate price-related pressures of late, and the CPI for new and used vehicles declined by 0.9% in October after an average monthly increase of 0.8% over the previous twelve months.

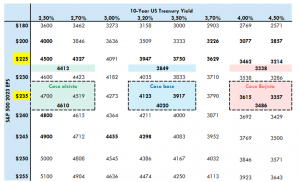

Weaker core inflation is good news for the Fed. Policymakers have indicated that their preferred next step would be to reduce the pace of rate hikes to 50 basis points at the December FOMC. Indeed, futures markets expect 50-25-25 basis points for the next three meetings. So, the market believes there is about 100 basis points to go before the Fed ends the tightening cycle with a terminal rate around 5%.

Market Scope