As widely expected, the Fed raised the federal funds rate by 25 basis points to a current range of 4.5% to 4.75%. That move was another step towards further moderation following the previous 50 basis point increase and the four 75 basis point increases at the four FOMC (Federal Open Market Committee) meetings before that.

In its statement, the "committee anticipates that continued increases in the target range will be appropriate to achieve a monetary policy stance that is sufficiently restrictive to return inflation to 2 percent over time". That was essentially a repeat of language it has used in previous statements.

Indicating that the end of the cycle is approaching, the language on inflation in the statement softened, to note that inflation "has eased a bit" reflecting growing confidence in the inflation peak and that inflation is moving more "in the rearview mirror." a message that was reinforced at the press conference, where Chairman Powell favorably mentioned ongoing or expected "disinflation.".

The Fed is still concerned about "the risk of doing too little," while "the risk of tightening too much" seemed less of a concern, as they have tools that would work in that case.

Now, when asked about the recent easing in financial conditions, Powell did not seem overly concerned. In fact, he did not believe that conditions changed much over the past six weeks and continues to believe that conditions have "tightened significantly" over the past year, something quite questionable when looking at any chart of financial conditions, which show that they are at the same levels as in July despite the Fed having raised interest rates an additional 375 basis points since then.

U.S. financial conditions are at the same levels as in July despite the Fed having raised interest rates an additional 350 basis points since then.

Federal funds rate vs. financial conditions

Similarly, he was not concerned about the divergence between plot* dots and market prices (rate forwards), saying it reflected a "difference in outlook" and, more importantly, that the market has a more benign inflation outlook than the Fed.

With respect to this point, we believe that what could end up tipping the balance to dissuade the market from pricing in rate cuts in the second half of this year is the continued strength of the labor market, which continues to be categorized as tight.

Markets are not only incorporating a further moderation in the pace of rate hikes by the Fed, but also a lower terminal rate and outright a pivot, with rate cuts starting in the second half of 2023.

Federal funds rate dot plot vs market

Going forward we expect any additional increases to be at the rate of 25 basis points; but the Fed is likely to have more work ahead to convince markets that rate cuts are unlikely by year-end, unless there is a more significant deterioration in the economy and/or labor market.

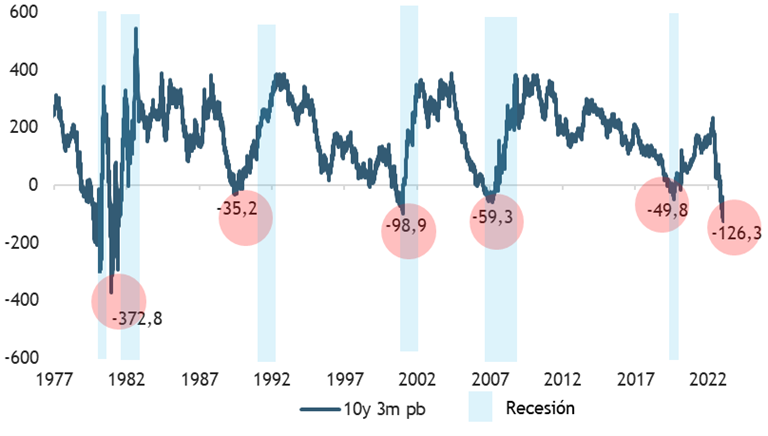

For now, the U.S. economy remains in the midst of a marked slowdown in the consumer goods and housing market, but higher spending on services serves as a positive offset for now.. A recession remains a risk given the messages emanating from a deeply inverted yield curve. However, the key thing to remember is that the stock market is a quintessential leading indicator and, as is often the case, should lead the economy as it eventually stabilizes. That is not to say that the bear market is over, but rather that a good deal of the "economic pain" and inflation that has already been experienced has gone away reflected in the market adjustment that has been underway over the past 12 months.

The inversion of the yield curve has preceded every recession since the 1970s.

Slope of the curve 10y3m

As expected, Powell's "more moderate" tone was well received by the markets. However, for equities we continue to believe that the upside is limited (especially for the US case), with unattractive valuations and the increased risk on corporate earnings prospects. Where we do see a decreasing downside is in the bond market (See more here).