In the last few months, there have been several significant events in the financial world, such as the run on Silicon Valley Bank, the Fed's intervention that led to the closure of Signature Bank and the acquisition of Credit Suisse by UBS, among others.among others. These events have generated greater concern about the solvency of banks and have cast doubt on the have cast doubt on the effectiveness of current banking regulation.

In this context, the extension of the asset limit for banks subject to the Dodd-Frank Act has been criticized. This law regulates banks with more than USD$50 billion in assets, requiring them to have capital requirements, annual stress tests, and other measures aimed at improving financial stability.

In 2018, this limit was raised to USD$250 billion, with the rationale of encouraging competition between large and small banks, and stimulating economic growthThe limit was raised to USD$250 billion in 2018 on the grounds that stricter regulation could limit the amount of credit banks can offer.

However, banks are not the only institutions that generate loans in an economy. Therefore, this decrease in the supply of credit in an economy could be replaced by other non-bank financial institutions.

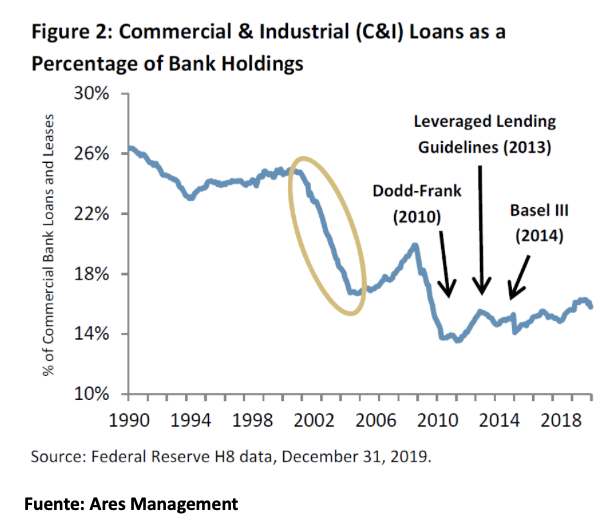

The following chart shows the exposure of U.S. banks to commercial and industrial (C&I) loans since 1980.

These loans are used by many companies, especially small and medium-sized ones, because they do not have the advantage that large companies have of being able to access the financial market for financing. Two main decreases can be seen.

First, the consolidation stage of commercial banks that began in the late 1990s, where regional banks carried out mergers and acquisitions, impacting their lending to small and medium-sized companies. This occurred due to the increase in the size of commercial banks, so that they began to have the possibility and preference to make large loans to larger companies.

Second, the banking regulation that was put in place after the Great Recession, where one can recognize the Dodd-Frank Act, guidelines for leveraged lending, and Basel III. Dodd-Frank Act, the leveraged lending guidelines, and Basel III. These three regulations further restricted the growth of bank credit in the United States.

Given the current state of the banking sector and its importance in the economy, there has been discussion about the need to regulate smaller banks more strictly. According to the Financial Times, the Fed is considering stricter regulation of medium-sized banks. While this may result in a tightening of credit and slow economic activity, it also opens up opportunities in the private debt market.

While not the only factor driving the growth of the private debt industry, tighter regulation of mid-sized banks in the U.S. could limit access to bank credit for private companies, which could benefit non-bank financial institutions that provide private debt, as they are not subject to the same regulation.

Vicente Dourthé Orrego - Private Debt Team Fynsa AGF