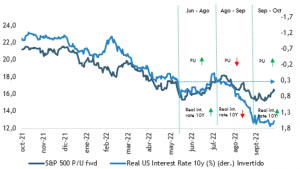

Equity markets remain caught in a delicate balance between interest rates, valuations and corporate earnings. And if you look at the attached charts, the market has basically gone nowhere since June, with downward pressures on valuations, due to higher interest rates, being partially offset by the resilience of corporate earnings.

Stock markets remain caught in a delicate balance between interest rates, valuations and corporate earnings.

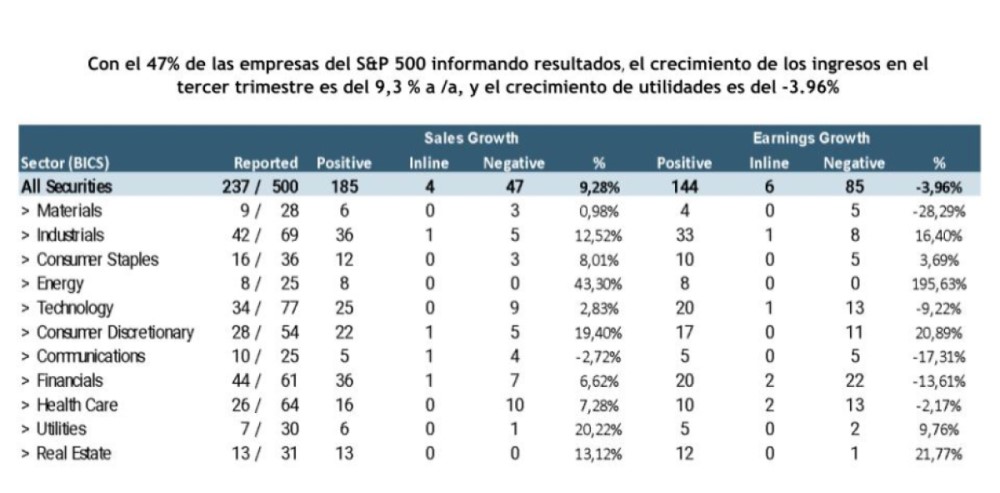

Most recently, the rise in equities may reflect some rotation into value sectors and anticipation of a future "Fed pivot", which has led to some expansion in multiples, but has little to do with 3Q22 corporate results, which until last week had been mostly surprisingly bullish.which, until last week, had been surprising mostly on the upsideThe current week's results have delivered big negative surprises, especially in large technology, communications and consumer discretionary companies. Some data in this regard:

These technology companies flourished during the pandemic, as life and work moved more to the Internet, driving sales and encouraging companies that were already growing rapidly to accelerate hiring and investment. Now, one after another, the engines that drove that increased growth are in question. Sales of personal computers and other devices are falling. Consumers, hit by inflation, are cutting back on spending, while businesses are adjusting their outlays for everything from digital ads to IT services.

We identify 2 problems behind this dynamic of corporate results: (1) The weight that these sectors continue to have in the overall index (between technology, consumer discretionary and communications we have almost half of the S&P 500) and that (between technology, consumer discretionary and communications we have almost half of the S&P 500) and that (2) except for communications, which trades at a discount to their long-term averages, technology and consumer discretionary still trade at a 20% premium as measured by P/U fwd multiples.

So then, as the macroeconomic environment becomes much more challenging in the coming quarters, it seems unlikely that we will receive further support from the corporate earnings side, leaving the market totally dependent on a potential "Policy Pivot", it seems unlikely that we will receive further support from the corporate earnings side, leaving the market totally dependent on a potential "Policy Pivot", which is no longer even so much about a pause and less about potential interest rate cuts, but rather, a more gradual pace of rate hikes.

In this sense, as happened this week with the BoC (Bank of Canada) and the ECB (European Central Bank), which, beyond continuing to raise interest rates, adopted a rather moderate tone, the US Fed also seems interested in slowing the pace of tightening after unusually large interest rate hikes, given the focus on financial risks and lagging elements of inflation, although disappointing news on inflation could quickly dash those hopes. If the economy stays out of recession in the coming months, which we think is likely, this would raise the risk of a more gradual, but extended Fed cycle through 2023.