Last week we argued that "more positive" news on US inflation will revive trading based on a "policy pivot", with the understanding that lower interest rate pressures mean less pressure on valuations at a time when corporate visibility was somewhat challenged after 3Q22 results, with further downward revisions to earnings. on the understanding that lower interest rate pressures mean less pressure on valuations at a time when corporate visibility was somewhat challenged after 3Q22 results, with further downward revisions in expected earnings for 2023 (See HERE) .

We also reaffirmed our projections that U.S. equities were already approaching fairer value levels again, which could be exaggerated, admittedly, but limits the potential for further recovery.which may be overstated, to be sure, but limits the potential for further recovery, as both absolute and relative valuations relative to bonds are not particularly attractive.We also reaffirmed our projections that US equities were already approaching more fair value levels again, which may be overstated, but limits the potential for further recovery, as both absolute and relative valuations relative to bonds are not particularly attractive.

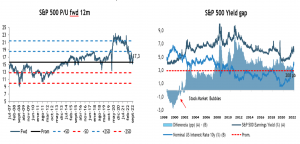

The S&P 500 trades at 17.3x forward earnings (+1DS above its long-term averages), while the premium offered by stocks over bonds has shrunk to 200 bps, 100 bps below their long-term averages and the lowest level in 15 years.

The current recovery, as in the July-August period is driven by the hope that US inflation has "peaked" and the view that the Fed will soon share this diagnosis. The previous experience proved to be more of a good opportunity to sell and reassess risk exposure, and while we recognize the progress in terms of monetary tightening and lower inflationary pressures at the margin, we cannot rule out history repeating itself.

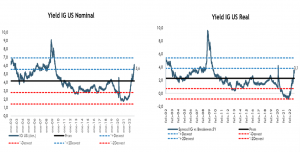

That said, where we do see things starting to look more attractive is in the bond market. US IG debt is now offering a rate of 5.5% (it was as high as 6.0% just a few weeks ago), the highest level in 15 years, which if adjusted for expected inflation over the medium term, results in a real rate of 3.0%.

Look at what happens when compared to the implied yield offered by equities today. It is practically the same yield! In other words, the spread between the implied yield offered by equities (inverse of P/U) and the yield offered by IG debt is practically zero, the lowest level since before the financial crisis. In the pre-pandemic deflationary world, equities had virtually no competition, "today they have started to get out of the way", and while equities have a relative advantage over bonds in a more inflationary environment, as inflationary pressures begin to moderate, an intermediate step in risk taking should be via investment grade fixed income, especially for moderate investment profiles.