In July, when the headlines of a possible recession in the U.S. were taking the agenda given the contraction of the economy in the second quarter, we organized a Webinar, where we addressed how likely it was at that time that the U.S. economy was on the verge of a recession (see HERE). Our conclusions at that time pointed to a low risk of recession, (even though the market decline, mainly equities, pointed to a high probability), given that from an economic and corporate point of view the evidence was scarce, with a consumer in good shape, a strong labor market and robust corporate balance sheets.

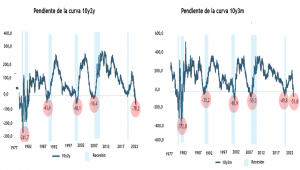

Likewise, the evidence from the yield curve (a fairly effective predictor), did not give any major signs of an imminent risk of recession either, with a rather flat curve and a monetary policy far from being restrictive.

Fast forward to today and several things have changed

And as shown in the accompanying charts, yield curve inversion has preceded every recession since the 1970s. So the question that follows is: Why should this time be any different?

Beyond the signals from the bond market, equity markets have not shown any major stress, under the assumption that the expected "moderation" in the pace of rate tightening by the FED would be enough to avoid a recession. It can also be explained by the time lag between the curve inverting (remember that this is a warning sign, not a full-blown recession) and the economy actually falling into recession, which on average is around 12 months, during which time the markets can still be profitable.

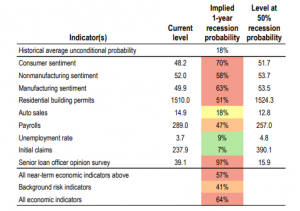

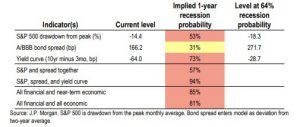

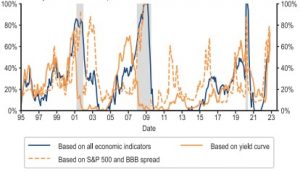

Statistics plus, statistics minus, what we are interested in stating is that the risks of recession have been increasing and that unlike what we had in July, where the probability of recession in the US at one year measured by different models (economic and financial), pointed to a relatively low probability that on average did not exceed 30%. Those numbers now exceed 50%, as shown in the attached JPM tables.

Finally, most baseline scenarios for 2023 assume either a soft landing or a mild recession, under the assumption that inflation will slow significantly and that the terminal policy rate would be in the 5.0% - 5.25% range, something already largely built into prices (so anything much tighter than that would bring the economy closer to a hard landing). The problem is that, even in a soft landing scenario, the potential upside for risk assets appears limited. In other words, the risk-return ratio from current levels is not attractive, which is one of the reasons why last week we recommended increasing exposure to fixed income and cash (short treasuries yielding over 4.5%) ahead of a 2023 that, in the first instance, looks quite uncertain (vsee HERE ).